Central bank stands pat but hints at rate hikes

Personal debt loads remain 'the biggest domestic risk' to Canada's economy

Latest

- Loonie gains almost 1 cent on hawkish statement

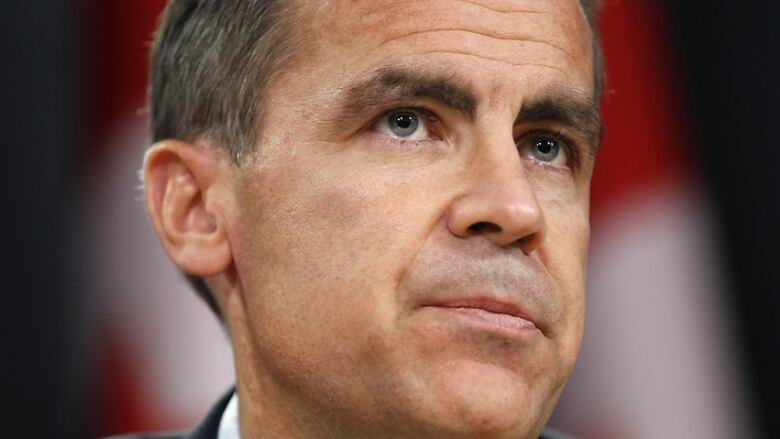

Bank of Canada governor Mark Carney elected today to keep the benchmark target for the overnight rate unchanged at one per cent, a level held at since September 2010.

Despite standing pat for the 13th consecutive policy session, the central bank offered a few hints that the outlook has improved enough to consider raising interest rates sooner rather than later.

The bank may have held steady, but the choice of words in the statement accompanying the decision itself "sent a clear signal that it may not stay there a whole lot longer," BMO economist Doug Porter noted.

The central bank tipped its hand most obviously near the end of the statement.

"Some modest withdrawal of the present considerable monetary policy stimulus may become appropriate," the bank said Tuesday. That may not sound overly aggressive, but comparedto previous statements, it's tellingly hawkish.

In its outlook, the bank raised its forecast for Canada's economy this year.

'Slack' in economy is tightening

The bank now expects the economy to expand by 2.4 per cent in 2012 and 2013, a rise from two per cent previously. That stronger growth in an environment of low rates is a recipe for inflation, something the central bank is mandated to keep in a range of between two and three per cent.

The bank also said that personal debt loads remain "the biggest domestic risk" to Canada's economy, an additional sign the bank is getting closer to making good on its repeated warnings for Canadians to get their financial houses in order.

The bank also noted that some of the "slack" in the economy is tightening, meaning the economy is becoming more efficient another sign the bank has leeway to act.

The Canadian dollar rose sharply following the statement, gaining almost a full cent to 101.05 cents US within minutes of the bank's decision becoming public.

Thatreaction in the dollaractually made Bank of Canada governor Mark Carney's balancing act even harder, as the bank again cited the persistently high Canadianloonie as a drag on growth moving forward. Raising rates will add more lift to the loonie, widening the spread with Canada's major trading partner, the U.S., which would in turn slow Canada's economy.

Some saya strong loonie isn't Carney's only conundrum.

Capital Economics analyst David Madani said hethinks Carney is genuine in his desire to discourage Canadians from taking on more debt.Buthe said taking action toward that would be a shock to the economy in the short term at least. "If the bank did actually raise rates, we suspect that it would have to reverse course again pretty quickly as the housing market slumped,"Madani said.

Beyond a vague pledge to raise rates if it was "appropriate," the bank was characteristically vague in the details.Still,most experts predict a hike some time later this year, or possibly into 2013 at the latest.

"The bank is clearly uncomfortable with keeping interest rates below inflation when household debt continues to grind higher, and with the economy poised to reach capacity by early next year," Porter said. "At a minimum, the bank will be raising ratessometime in the first half of next year."

"I would interpret that as something on the order of three quarter-point hikes [to 1.75 per cent] and then followed by another pause," CIBC economist Avery Shenfeld said.

With files from The Canadian Press

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)