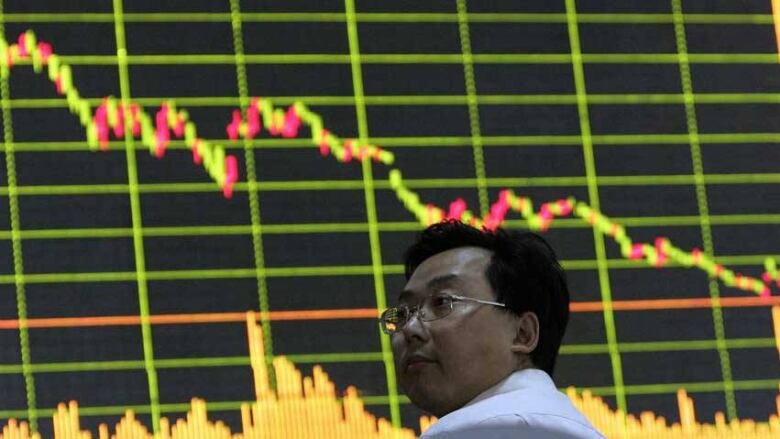

Dow drops 200 points on bleak earnings, China forecast

U.S. stocks slump due to global uncertainty

U.S. stocks took a 200-point plunge today as earnings and forecasts from several companies disappointed investors.

The Dow Jones industrial average was down 210 points or 1.3 per cent in lateafternoon, but recovered slightly to 16,197, down 176 on the day. Disappointing results from MacDonalds,KeyCorp andJohnson Controls helped trigger the slide.

Investors also worried about a slowdown in China, a major driver of global growth, after a survey suggested the country's factory sector was contracting.

The Standard & Poor's 500 index fell 16 pointsto 1,828. Toronto stocks followed the U.S. market down, but the slide was not as steep, down 55 points or 0.4per cent at 13,932 at the end of the day.

In Toronto, a recovery in gold stocks, buoyed by a jump in gold prices, failed to halt the slide. The financial sector was down, led by drops for Royal Bank and Bank of Nova Scotia.

At the same time, yields on U.S. Treasury bills gained, indicating declining confidence in the U.S. economy.

After rising 26 per cent in 2013, many traders believe the Dow Jones index is due for a correction. Since earnings season began last week, there have been disappointments from Intel, Best Buy and IBM. U.S. holiday retail sales were dampened by deep discounts in prices, which may mean more poor outlooks in the retail sector.

Only Netflix, which reported a 2.3 million increase in subscribers yesterday, was a high point. Its stock rose 16.5 per cent to $388.42 US.

Asian markets ended broadly lower after a preliminary reading of HSBC's purchasing managers' index for China fell to the lowest level since July.New orders, exports, employment and backlogs all showed declines.

"Not only is China not rebounding, but it looks like it may continue to struggle for some time into this year," said Colin Cieszynski, senior market analyst at CMC Markets Canada.

At the same time, the Federal Reserve pulled back on its bond-buying program to $75 billion a month in January and could announce a decision to taper further as soon as next week.

With files from the Associated Press

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)