Home renovation spending heats up again after COVID-19 pandemic led to deep freeze

Lines of credit a popular way to fund renovations, including for home offices

After rising to a record high last year in Canada, spending on home renovations fell off a cliff in the early days of the COVID-19 pandemic.

Butthe months of lockdowns and the seemingly endless purgatory of working from homehave Canadians once again opening up their wallets to make their temporary workplacesas tolerable as possible.

In a recent report, Toronto-based real estate consultancy Altus Group calculated that Canadians spent more than $80 billion on home improvements last year, atally that outpaced growth in the overall economy.

And the year's home reno boom was especially impressive, considering that the sector shrank by more than five per cent the year before.

"If we go back to last spring, interest rates were tumbling, so we were riding quite high," Altus Group's chief economist Peter Norman said in an interview with CBC News.

The $80.1 billion that Canadians spent on fixing up existing homes last yearwas more than they spent on new ones and it was a big reason why businesses that tailor to that market were feeling hopeful that 2020 was going to be another strong year.

Then COVID-19 struck andjust as the pandemic had a negative impactonalmost everything else in the economy, it brought that spending to a grinding halt. What was shaping up to bea strong year for renovations cooled off completely in March and April.

Altus Group is now forecasting that after a record 2019, spending on home renovations will fall in every province this year.

Norman saidthere's a delay of a few months in the data, so only now is there some sense of what sort of activity was taking place in May and June. But it seems that all those months cooped up at home compelled Canadians to move ahead with home reno projects they either weren't planning beforeor put on pause in March and April.

That's no surprise to Melanna Giannakis. As a branch manager withMeridian Credit Union, she saidthe activity at her branch in Fonthill, Ont.,a community in the Niagara region ofsouthern Ontario,mirrors the trends that Altusis seeing across the country: booming demand, followed by a complete deep freezeand now a resurgence.

Line of credit debt grows to pay for renos

Much of that activity is being paid for by homeowners borrowing against the equity in their propertyto tailor their houseto the new reality of their lives.

"At the beginning of the pandemic, the annual growth rate of home equity lines of creditdoubled and nearly tripled for personal use," Giannakis said in an interview.

Some of that money waslikely used to pay the bills as incomes felland job losses added up in the early days of March and April.

But a lot of it has beengoing to pay for home renovations.

"One of the main things I'm finding is people are less concerned about where they are living and more concerned with how they are living," Giannakis said.

The massive rise in the number of people working from home has changed the game for real estate, as millions of Canadians are now less tethered to downtown offices. That'sleading to a real estate boom in remote, less dense environments.

Those staying put in urban centres want to spend money to maketheir homes better suited for them in the new reality, Giannakis said.

"People want more roomand more space home offices with nice backdrops for video conferencing, for example, home gyms, finished basements, backyards pools.... They want their own little hideaway they can hunker down in."

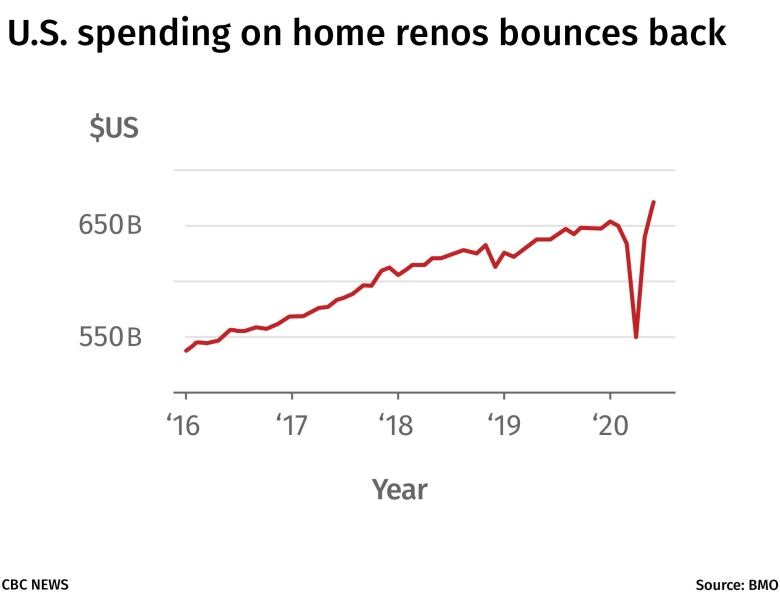

It's not just a Canadian trend, either. Bank of Montreal economist Sal Guatieri noted in a recent report that after plummetting in March and April, U.S. consumers are spending more than ever on their homes again. In June, spending onhousehold furnishings, equipment and maintenance eclipsed $650 billion US in June and is now back above its pre-pandemic level.

"Telework has already spurred spending on home comfort," he said, especially for one type of renovation: home offices. "Demand for in-home office renovations looks to have risen sharply."

That's not to suggest thathomeowners are spending willy-nilly. Norman citedAltus data showing that the number of homeowners planning renos costing at least $5,000 has declinedcompared withlast year, but it's still rising from its March low.

While indications arethat the reno market is recovering strongly, the decline was so steep that even with the current boom, it's unlikely that spending in 2020 will come out ahead of last year's strong pace.

"We do expect things to be a little bit subdued this year relative to the last year," Norman said.

"We just won't see that same rate of growth."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)