The high cost of the low-interest rate war on savers

Even a consumer advocate like Ralph Nader is saying enough with the cheap money

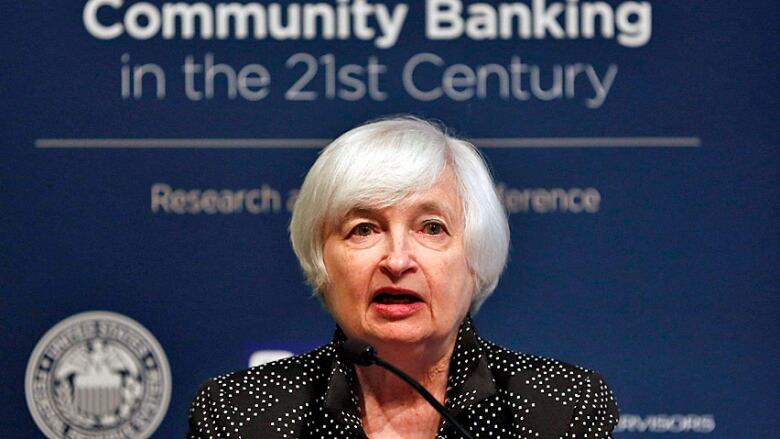

There's a lot of "Oh, snap" and high-fiving on the internet about Janet Yellen's comeback to Ralph Nader this week.

"Ralph Nader wrote Janet Yellen a sexist letter," declared Vox, on its business and finance website. "Her response is a fantastic short lesson in monetary policy."

Well, first of all, Nader's letter wasn't sexist. He merely advised the chairwoman of the U.S. Federal Reserve to sit down with her "Nobel Prize-winning husband, economist George Akerlof, who is known to be consumer-sensitive," and figure out some way to help millions of retired Americans.

Let's remember here that Nader, whom I've encountered flying coach and eating a cold sandwich, has dedicated his life to defending ordinary consumers.

Let's also remember that Janet Yellen is in charge of an incredibly powerful, secretive government institution that used public money to protect super-wealthy U.S. bankers seven years ago while millions of Americans were ruined or beggared by the reckless pump-and-dump schemes Wall Street had been running.

That Yellen happens to be a woman and Nader a man is irrelevant.

What is important, and largely not discussed, is the point Nader was making: that ultra-low interest rates have hurt retirees and savers, not just in America, but in every Western nation that used cheap money to grease the financial system when it was about to seize up.

- Canada's housing market faces looming demographic bubble

- Fed minutes signal December rate hike likely

Massive transfer of wealth

Older people tend to have savings, and for much of their lives they planned, reasonably, on those savings to generate a modest return to help them get by in retirement.

As Nader wrote Yellen: "Think about the elderly among us who need to supplement their social security checks every month."

Older people, with their much shorter horizons, cannot afford to take the risks involved in playing stock markets.

Instead, they put their money into government bonds, or annuities, or things like GICs, which are safer, but which now pay returns so paltry that they canreturn less money once inflation is taken into account.

In Canada, interest rates are even lower than in the U.S. And retirees are hurting here, too.

But our consumer movement is supine compared to the Americans. We could probably use a Ralph Nader or two.

To give Yellen and other central bankers credit, their decision to reduce the bank rate to practically nothing did limit the financial meltdown in the fall of 2008.

Printing trillions of dollars and pumping it into the banking system ensured rates would stay extremely low, and encouraged investors to take risks to buy stocks, for example, which is part of the reason why the Dow Jones index is where it is today.

It also made buying a house possible for many young people wanting to get into markets that had collapsed, in the U.S. and elsewhere.

That said, the low interest rate policy is, as noted British pension campaigner Ros Altmann (recently appointed to the House of Lords) told me in 2012, a "monumental social experiment" a massive transfer of wealth from older to younger citizens. From savers to debtors.

Yellen, during her confirmation hearings two years ago, also acknowledged savers are suffering. But her justification was more or less the same thing she replied to Nader this week:

Had interest rates not been lowered, she wrote, the meltdown would have been catastrophic.

"True," she told Nader, "savers could have seen higher returns on their federally-insured deposits, but these returns would hardly have offset the more dramatic declines they would have experienced in the value of their homes and retirement accounts."

Same argument here

Bank of Canada governor Stephen Poloz, Yellen's Canadian counterpart, uses the same talking points.

In a speech last May, he said he hears from Canadians who say "'I'm struggling, you know, I'm a retiree, you know.I'm living off interest and so on.'

"And I ask retirees to think about how bad the retirement plan could have looked like if we had the second Great Depression."

Still, you'd think that it's probably time, this many years after the frantic, frightening autumn of 2008, to consider whether the wealth transfer experiment should continue.

Especially, as Nader wrote so caustically, when banks, which borrow from the Fed for almost nothing, proceed to gouge U.S. students, who carry debt of $1.3 trillion, with rates of between six and nine per cent.

Or when certain credit card companies and payday loan outfits effectively charge loan shark-level vig.

But Yellen, and Poloz, may now be stuck in a situation of their own making. The market keeps anticipating a small rise in the Fed rate, and the Fed keeps putting even that off.

For one thing, Canadian and American consumers are now addicted to cheap money. A serious rise, a point or two, could puncture housing markets, especially in some Canadian cities, where low interest rates helped push prices into the ionosphere and beyond.

Hundreds of thousands of Canadian households are stretched, some so thin they'd be unable to cope with a rise of one per cent, let alone a return to normal levels.

Stock markets, too, have floated upward on all that cheap money. There isn't much doubt how they'd react to a spike in rates.

Nader is absolutely right. Penalizing savers was unfair.

But then, that's our social compact. The virtuous subsidize the venal and the greater fools, as economists would call them.

In a way, prudent savers struggling in retirement are like those poor wretches in American cities who faithfully paid their mortgages for years, only to watch helplessly as foreclosures boarded up adjacent homes, tearing the guts out of their neighbourhoods and property values.

They're collateral damage. Unfortunate, you know, but unavoidable. Fog of financial war, and so on.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)