Winnipeg pro sports clubs to collect $16.3M in public assistance in 2018

City budget documents suggest small rise in combined support for Winnipeg Jets, Blue Bombers and Goldeyes

Winnipeg's professional sports clubs are in line for about $16.3million of government assistance next year, thanks to a combination of gaming revenue as well as taxbreaks, tax refunds and tax exemptions.

City budget documents showgovernment support for the private owners of the Winnipeg Jets andthe Winnipeg Goldeyes, and the non-profit organization that runs the Winnipeg Blue Bombers, is expected to rise by a total of roughly $1.1million next year, mainly because of an increase in ticket revenue at Bell MTSPlace, Investors Group Field and Shaw Park.

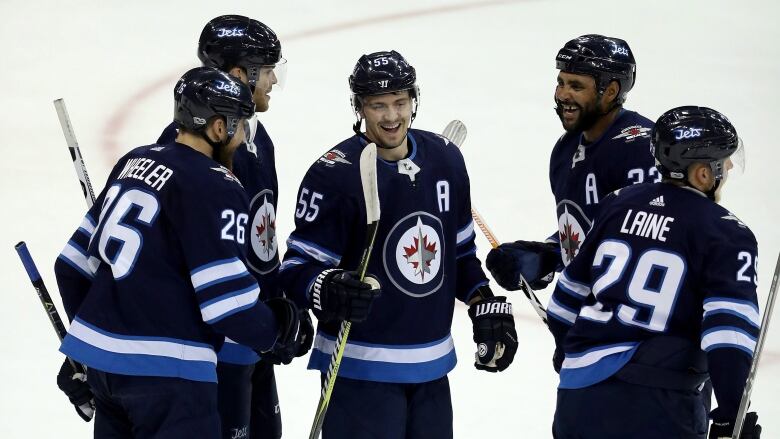

True North Sports & Entertainment,which owns theNHLWinnipeg Jets and the AHLManitoba Moose, is in line for a total of$14.1million worth of operating subsidies and public funding in 2018.

That's roughly equal to the combined salaries of starting goalie Connor Hellebuyck, centreMark Scheifele and right-winger Blake Wheeler this season, according to salary-tracking site capfriendly.com.

- Winnipeg budget 2018: Bus fares and parking fees up, infrastructure spending down

- Winnipeg pro sports franchises in line for $15.2M score in 2017

True North is expected to receive a $7.65-millionentertainment tax refund from the city, an increase of $650,000 from 2017. The owner of Bell MTSPlaceis also eligible for a $244,000 city business-tax refund, unchanged from last year,as well as a city-provincial property-tax break of about $740,000.

Provincial legislation allows the downtown arenato be considered recreational property for tax purposes, rather than commercial property. This allows tax assessors to portion most of the buildingat 10 per cent of its assessed value, rather than 65 per cent.

Tax breaks and gaming revenue

True North also receivesan estimated$5.5million worth of revenue from 140 gaming machines at the Shark Club at Cityplace mall. That's the average expected revenue froma deal reached between True North and Manitoba Liquor & Lotteries under the formerNDP government.

Under the terms of the deal, if the Shark Club generates less than $6.1 million a year in gaming revenue, True North gets to keep 90 per cent of that money, which works out to a maximum of $5.49 million.

If Shark Club revenue ends upbetween $6.1 million and $7.3 million, True North receives a flat payout of $5.5 million. If the club's machines generate more than $7.3 million, True North gets to keep 75 per cent of thefirst $7.3 million which works out to $5.48 million plus 20 per cent of any revenue beyond $7.3 million.

Manitoba Liquor & Lotteries keeps the rest of the cash under all three scenarios.

Council finance chair ScottGillingham(St.James-Brooklands-Weston) said while the city is strapped for cash, ithonours its agreements with True North.

"We have an obligation to fulfil our end of those respective contracts," Gillingham said Tuesday in a telephone interview.

True North vice-president RobWoznydeclinedto comment, but pointed to a March 1 statement by True North chairman Mark Chipman that said his company contributed $210 million to the Manitoba economy in 2015-16, generated $45 million in tax revenue for three levels of government and created 1,473 jobs.

After True North, the Winnipeg Football Club is No. 2 in terms of public assistance. The non-profit organization that runsthe Winnipeg Blue Bombersis entitled to $1.85million worth of government assistance next year.

That comes in the form a $1.85-million entertainment tax refund, an increase of $450,000from 2017.

The Bombers are also exempt from paying city business taxes, thanks to the football club's non-profit status. The club also doesn't pay property taxes to the city or province because Investors Group Field is owned by the University of Manitoba. Educational properties are portioned at a zero per cent rate by tax assessors.

City spokesperson Lisa Fraser said it's impossible to calculate the value of the Investors Group Field property tax break because the stadium is undergoing renovations.

Winnipeg Football Club communications director Darren Cameron declined to comment.

The smallest recipient of government assistance among the city's pro-sports franchises is the Winnipeg Goldeyes, which stands to receive $342,400 worth of help next year.

That comes in the form of a $300,000 entertainment tax rebate up from $270,000 in 2017 and a $42,400 municipal property tax refund, which will rise$6,400 from 2017.

Economic Development Winnipeg CEO Dayna Spiringsaid the Jets, Bombers and Goldeyescontribute to the economy by attracting tourists, creating jobs and generating revenue for governments.

"Through direct and indirect job creation, economic activity generated from our professional sports teams provides economic value," Spiring saidTuesday in a statement.

"In addition, they positively impact Winnipeg's reputation across the continent. The value our sports teams provide are important, both for our own residents as well as people and companies we're trying to attract."

The size of the subsidy, however, is not commensurate with success on the ice or on the field.

The Winnipeg Jets have not won a playoff game since the franchise moved here from Atlanta in 2011, whilethe Winnipeg Blue Bombers have not won a Grey Cup since 1990.

The WinnipegGoldeyeshave won three championships in the last six years, includingback-to-back American Association trophies in 2016 and 2017,chief financial officer Jason McCrae-King noted in a statement.

True North Sports & Entertainment

- Total 2018operating subsidies/public funding: $14.1million

- Entertainmenttax refund(city): $7.65 million

- Gaming revenue, estimated(province): $5.5 million

- Property tax break, estimated(city and province): $740,000

- Business tax refund(city): $244,000

Winnipeg Football Club

- Calculable total 2018subsidies/public funding: $1.85million

- Entertainmenttax refund(city): $1.85million

- Property tax exemption(city, province): No taxes on U of M-owned land.

- Business tax exemption(city): No taxes for non-profit organization.

Winnipeg Goldeyes

- Total 2018subsidies/public funding: $342,400

- Entertainmenttax refund(city): $300,000

- Property tax grant(city): $42,400

With files from Jacques Marcoux

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)