Irving LNG tax break tough to undo, advises city solicitor

John Nugent informs city council there is likely nothing city can do to void 25-year tax concession

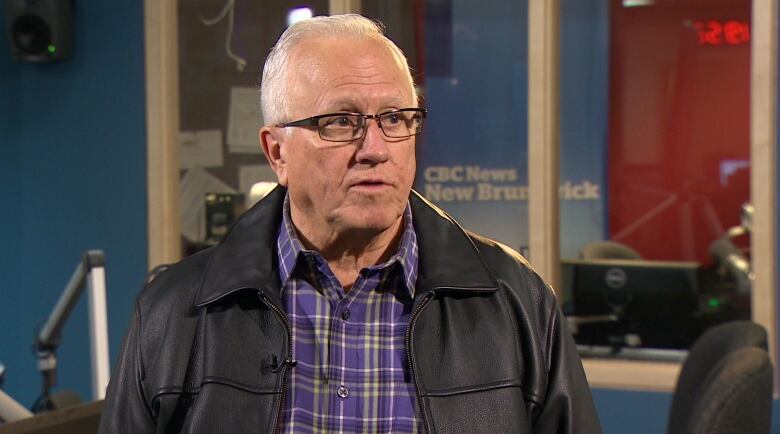

Saint John politicians were almost certainly not told about a $200 to $300 million land lease deal in the works for Irving Oil before they backed substantial tax concessions for an LNG development 10 years ago, city solicitor John Nugent has concluded in a new report headed to city council.

- Irving Oil says Saint John's 'hands are tied' over LNG deal

- Saint John seeks 'full disclosure' over Canaport LNG tax deal

But Nugent says there is likely nothing the city can do legally since it did not sign any agreements or contracts with the company to spell out the terms of the 25-year concession, which reduces taxes on the lucrative property by more than 90 per cent to $500,000 per year. Without the concession, property taxes would be more than $8 million per year based on the property's current assessment.

No contract signed

"One must conclude that the Irving interests made no representation as to their anticipated financial benefit from the project to either the Mayor or Common Council," writes Nugent in a document to be presented to councilon Monday.

"In any event there was no contract Consequently the rules that might apply in a contractual context, such as the prohibition against misrepresentation during negotiations or unconscionability,do not find obvious application in this case."

Nugent was asked to prepare a report on the decade-old property tax concession following aseries of investigative reports by CBC News showing Irving Oil has been collecting US$12.25 million (CDN $16 million) a year in rent from the tax-reduced property which it leases to the LNG development.

A copy of the lease obtained by CBC News shows it was signed between Kenneth Irving and officials with the LNG partnership on June 6, 2005.That was three months after the city agreed to ask the province for a special property tax exemption, but before the exemption was formally approved.

Irving Oil has acknowledged that before it approached the city it had a memorandum of understanding with Repsol, its partner in the LNG development, that outlined much of the arrangements between the two, although it is unknown whether that included the value of the land lease.

Legal options limited

NeverthelessNugent says because the city did not seek proof of Irving Oil's need for the tax concession or sign an agreement laying out conditions for granting it, legal options to undo the deal are limited.

"It is my view that it is highly unlikely that the Supreme Court's recent recognition of a duty to act honestly in the performance of contractual obligations would operate in the circumstances at hand."

Future tax concessions "should be confirmed in a written contract," says Nugent so the city can take action if fit feels misled in some way.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)