New Brunswick cap on rent increases won't be enough to stop profiteering

Investors know they can get around the proposed cap on rent increases by renovicting tenants

In the budget this year, the New Brunswick governmentproposes a temporary 3.8 per cent cap on annual rent increases during 2022.

This cap would protect tenants only as long as they continued to live in the same home. Once a tenant moved out, the landlord would be permitted to increase the rent by an unlimited amount.

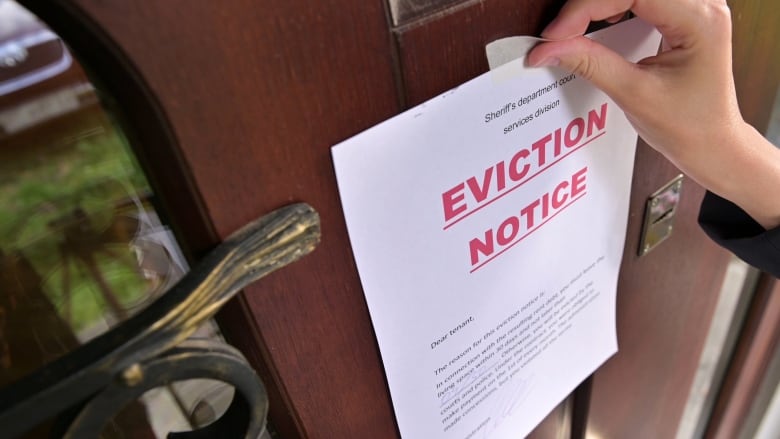

Such a system gives landlords a strong financial incentive to evict their current tenants by any possible means. For this reason, itis only as good as its eviction protections.

The eviction protections being proposed by the Blaine Higgs government are weak.

Landlords would be legally permitted to evict tenants because a relative wants to move in, or because the landlord decides to conduct extensive renovations requiring the unit to be vacant. Eviction would also be allowed ifthe landlord decided to use the unit for a non-residential use, including an Airbnb.

Landlords are already brainstorming other ways around the rent cap.

The Moncton Real Estate Investing Organization recently held a roundtable discussion in which landlords and property managers discussed using fixed-term leases that would force tenants to move out when the lease expired, asking tenants to personally agree to rent increases above the cap, and devising plans for extensive renovations, even if the work is not ultimately as significant as claimed.

Housing crisis like catnipfor investors

There's a word for what these landlords are doing. It's called profiteering, defined as making unreasonable profits on the sale of essential goods, especially during an emergency.

The same housing crisis that has created so much desperation and uncertainty for tenants has been like catnip for investors.

Before the rent cap was proposedin March, investors were rushing to snap up properties in New Brunswick, knowing that even if they overpaid, they could take advantage of the low vacancy rates and lack of rent control to jack up rents. Research by Prof. Martine August at the University of Waterloo suggests that investors deliberately target jurisdictions with weak or no rent control for this reason.

If investors know they can get around the rent cap by buying an older building and renovicting the tenants a strategy that Bloomberg has termed "buy and evict they will continue to buy up housing in New Brunswick. In the process, they will drive many New Brunswick tenants into homelessness, while also driving up house prices, preventing many potential first-time homebuyers from buying a home.

The Higgs government can make the rent cap effective in one of three ways.

Different things to cap

First, by temporarily implementing vacancy control. Instead of allowing landlords to increase rent by an unlimited amount after a tenant moves out, vacancy control caps annual rent increases whether the unit is occupied by the same tenant or not. This would eliminate the financial incentive to evict and make profiteering effectively impossible.

Second, by implementing a profit-cap rent control system like Switzerland's. Instead of capping annual rent increases, the Swiss cap the landlord's net return on his investment in the rental property.

The cap is set at the current mortgage rate plus a premium. The premium is currently two per cent, meaning that when mortgage rates are two per cent, a landlord can earn a net return of four per cent.

For landlords, a profit-cap system protects their ability to charge a rent that covers all of their costs and generates a predictable, commercially-relevant profit.

For tenants, it protects them against profiteering: if a landlord charges a rent that generates an excessive net return, the tenant can challenge it and have it reduced.

A profit-cap system would also be a powerful tool to encourage investment in new housing construction. The government could set a higher rate of return say 15 per cent on new construction, while capping the return on existing buildings at a lower rate.

Instead of "buy and evict," New Brunswick would see a rental housing construction boom.

Better protection for tenants

Third, by strengthening eviction protections. When a landlord seeks a no-fault eviction, tenants should be able to apply to extend their lease for up to four years if termination of the lease would cause hardship for the tenant or the tenant's family that cannot be justified by the interests of the landlord.

The Higgs government has choices. If it isserious about putting an end to profiteering and speculative investment, a rent cap coupled with weak eviction protections is not one of them.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)