Trumped? Energy East faces new obstacle

U.S. president's desire to approve Keystone XL could delay or scuttle plans for pipeline to Saint John

The Energy East pipeline problem has had its share of obstacles, but it's now facing the biggest potential roadblock to construction imaginable: the bombastic new president of the United States, Donald Trump.

With the stroke of a pen Tuesday, Trump made it official: he wants to approve the Keystone XL pipeline, another project proposed by the same builder, TransCanada Corp.

And that could make Energy East one pipeline too many for another decade or more, according to one forecast.

Trump's move "delays the time pressure to build Energy East" for a decade, says Trevor Tombe, an economist at the University of Calgary who studies energy, environment and trade.

If the Trudeau government declared there was no urgent need for a regulatory review of Energy East, Tombe said, "I think there's a strong case, and I don't think they'd get a lot of pushback there."

The goal was to get Alberta bitumen to the coast, where it could be loaded on tankers and sold overseas at a higher world market price than it could get in the U.S.

In particular, it's intended to get Canadian oil to India and around the tip of Florida to refineries on the Texas coast that Keystone was supposed to supply.

But that was before the price of oil crashed.

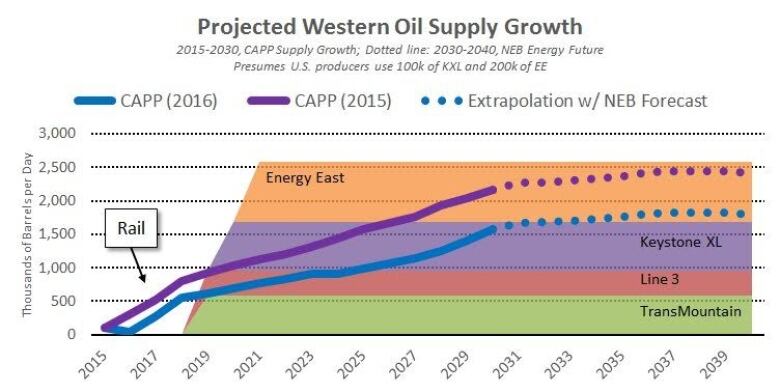

Forecasts though 2040

Tombe has created a graph showing the oil industry's recent forecasts for production growth through 2040.

It assumes two pipeline projects approved by Ottawa in December, Kinder Morgan's Trans Mountain and Enbridge's Line Three upgrade, will be built.

Under the 2015 forecast of two million more barrels, there'll be enough oil to fill both of them and Keystone XL by 2025, meaning Energy East would be needed around then.

But the revised 2016 forecast is for only 1.5 million more barrels because of low oil prices.

"It looks like Keystone wouldn't be fully utilized until about 2030," Tombe said.

In that scenario, Keystone XL would lessen the need for Energy East for more than a decade.

Keystone not a sure thing

But Trump's signature this week doesn't mean Keystone is a sure thing.

Trump said the project "was subject to a renegotiation of terms by us. We're going to renegotiate some of the terms, and if they'd like, we'll see if we can get that pipeline built."

During last year's campaign, he said he'd approve Keystone if the U.S. got "a piece of the profits."

He has also suggested he could force TransCanada to buy more of the steel for the project from U.S. manufacturers.

- Trump gives OK to Keystone XL and Dakota Access pipelines

- Trudeau welcomes Trump's Keystone XL decision

Those conditions might violate trade agreements. Reacting to Trump's comments last year, TransCanada said the U.S. government's role "is that of a regulator and granting appropriate permits. We would expect to continue to follow this model that has been in place for decades."

The company's CEO, Russ Girling, said this week the company was working quickly to resubmit its application to the new Trump administration and it was "premature to speculate" on how any new conditions might affect Keystone.

Other obstacles to Energy East

Assuming it happens, there are other obstacles to Energy East.

It's the more expensive of the two projects, at $15.7 billion.

As well, the National Energy Board hearings into the project have been on hold for six months after the review panelists recused themselves over private meetings they held with former Quebec premier Jean Charest, a TransCanada lobbyist.

Environmentalists are going to court to force the NEB to start all over, and some indigenous activists say they'll use their legal rights to try to stop the project.

So, given all those obstacles, might TransCanada decide Energy East isn't worth the trouble?

'Highly unpredictable'

Not necessarily, says Tombe.

"The energy markets in particular are highly unpredictable and things as we've seen in the last couple of years can change dramatically," he said.

The energy markets in particular are highly unpredictable and things as we've seen in the last couple of years can change dramatically.- Trevor Tombe, University of Calgary

Political opposition and legal challenges in British Columbia could still stall that project, and Trump's sabre-rattling could turn into a real impasse on Keystone "So there's a lot of risks that exist with all of the projects," Tombe said.

Energy East could also carry U.S. oil from North Dakota through a lateral line TransCanada wants to build.

That means the industry will likely want to keep Energy East moving through the approval process as a back-up plan.

"At the moment it still make sense to try and pursue Energy East as a hedge against what might go wrong with the other projects that are onstream."

Either way, Trump's move adds another element of uncertainty to a project that was already proving to be a big challenge.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)