Flooded twice, Constance Bay man says he's being punished for having insurance

Gerry Blyth still fighting province for disaster relief from 2017 flood

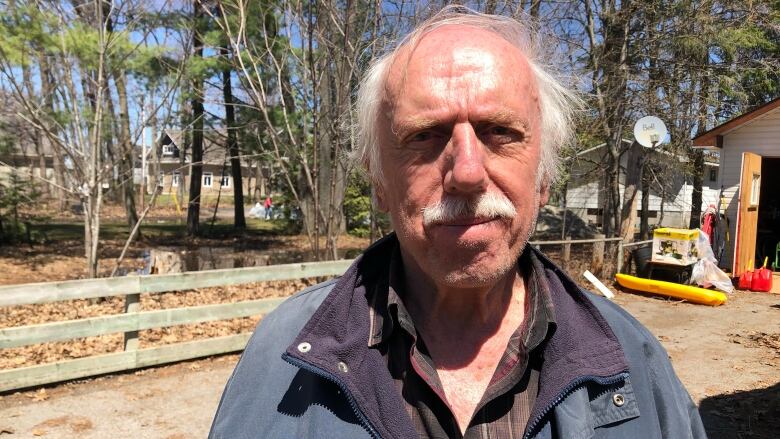

An Ottawa man whose basement is full of water for the second time in two years says he's still fightingthe province for disaster relief from the 2017 flood, and is blaming his predicament on the fact that he had insurance.

Gerry Blyth has lived in hismodest home on Bayview Drive in Constance Bay for about 30 years.

After his basement flooded in 2017, Blyth's insurance covered ruined appliances and otherdamage, but not structural repairs. So Blythapplied tothe Disaster Recovery Assistance for Ontarians (DRAO) programfor help repairing hisfoundation, which he saidhad shifted and cracked in the flood.

I look at people that didn't have a speck of [flood] insurancenot a speck of insurancethey've got new houses.-Gerry Blyth

He filled out a claim for about $20,000, but because he'dalready received money through hisinsurance, the Ministry of Municipal Affairs and Housingtold him he was only eligible for $10,369.38, before deductions.

"So there I am in this quandary now," Blyth said.

"I've got the insurance company saying, 'Well, this money is not for your foundation, it's to replace the appliances and other stuff,' and then the disaster relief people saying, 'Well, we have to deduct all the insurance you got, regardless of what it was for.'"

Not enough for repairs

Blythsaid the amount the province is offering isn't enough to repair his foundation he believes the job will cost at least twice that.

Blyth saidhe feels like he'sbeing punished for having insurance.

"I look at people that didn't have a speck of [flood] insurancenot a speck of insurancethey've got new houses," Blyth said.

On Tuesday, the Ontario government announced people living in some flooded parts of Ottawa, Clarence-Rockland, ChamplainTownship and Alfred and Plantagenetcan now apply forhelp covering their 2019 recovery expenses.

The Ministry's website states financial aid is limited to $250,000 per application, and that "insurance payments are deducted from eligible costs."

Under water again

Now Blyth's basement is once again filled with about 1.8 metresof water. During the peak of this spring's flooding,Blyth said he had eight electric pumps running in his basement and two gas-powered pumps working outside, but it wasn't enough.

Blythand his wife are both retired, and theirwaterfront home was a key part of their futureplan.

"So I'm really bitter and worried that if we have to sell the house now, who is going to buy a house with a faulty foundation? Nobody's going to buy a house with a faulty foundation," he said.

Blythsaid none of his neighbours seemed to have any problems with their DRAO claims. He's planning on filing a fresh claim this year, and he's urging the province to rethink its policy when it comes to relief forhomeowners with floodinsurance.

In a written statement, a spokesperson forthe Ministry of Municipal Affairs and Housing said the DRAO program is "intended to help people get back on their feet after a natural disaster."

"Applicants who have received funds from their insurance provider can only receive a payment under the DRAO program if they have spent the funds they have received through insurance coverage, and it is not sufficient to cover eligible costs for the essentials," said spokesperson Lee Alderson.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)