Insurance industry warns 'vigilance' needed to keep tow fees from boosting rates

CBC reports about two bills of close to $4K have led to more people coming forward

The Insurance Board of Canada says consumers need to know their rights to avoid high tow fees, which they say could start to affect premiums.

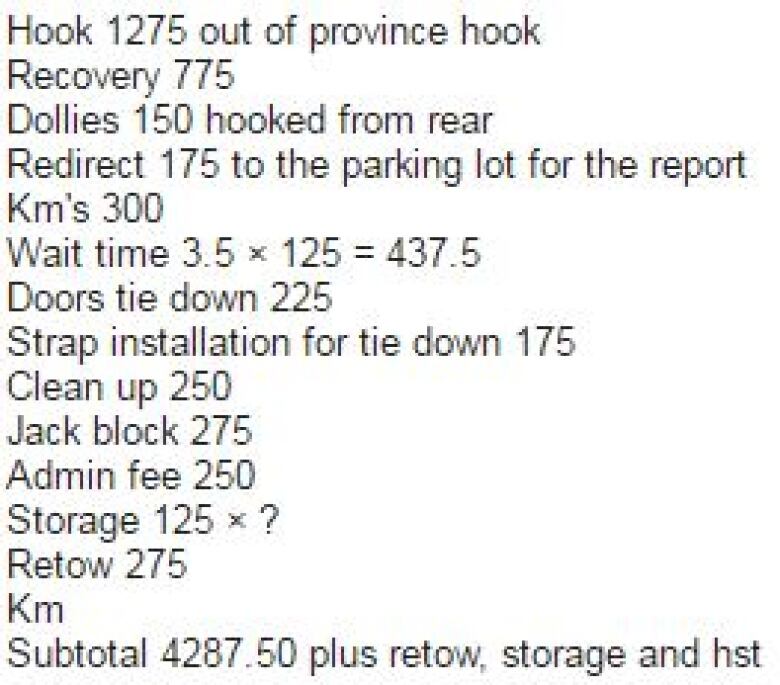

CBC has reported on tow bills in the Ottawa area costing $4,000, and repeated cases of high tow bills have led to one body shop manager calling for regulations.

In one case, the customer said he was told not to worry about payment because the insurance would handle it.

"No one should accept that answer first of all from a tow truck operator," said Pete Karageorgos, the Insurance Bureau's director of consumer and industry relations.

"Because the insurance company's payments for claim come from the premiums that we pay as consumers. To say that an insurance company will pay for it, really means we as drivers will pay for it in the end."

'Excessive, it's shocking'

Since CBC'sstories this month, other body shops in Ottawa and Gatineau have confirmed receiving tow bills between $1,000 and close to $5,000.

Karageorgoscalled those amounts "excessive" and "shocking."

Karageorgos said the insurance industry fights unfair charges through theRepair and Storage Liens Act. Sometimes a company will pay an excessive bill to the court and fight to have it reduced.

That can still lead to significant delays for people who are trying to get back to their normal lives after a crash.

"Cars sitting in a storage lot rather than in a body shop being repaired, that's time and money being wasted," he said.

Vigilance and up-frontpricing

However, Karageogos said consumers have a role to play in avoiding excessive costs and the possible increases in premiums that could follow.

"Being able to stop it from the front-end, rather than having to deal with it from the back-end, is obviously the preferred route," he said. "I think vigilance is the key."

The Consumer Protection Act requires a signed authorization for a tow, gives customers the right to anestimate of the towing company's ratesand says costs cannot exceed a quoted price by more than 10 per cent.

"Insurance companies and adjusters at the front line are constantly battling this, but also the education and awareness piece needs to be shared with consumers as well so they can assist in the campaign against these types of ridiculous charges," he said.

The Ministry of Government and Consumer Services handles the implementation of the Consumer Protection Act on the basis of individual complaints.

A spokesperson for the ministry said they cannot comment on specific cases or the enforcement of the act, but try to provide a form of mediation when disputes arise.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)